Australian mining group IGO has reported a decrease in lithium spodumene and nickel production for the financial year ending in June 2024. The company also announced that its Forrestania nickel project will transition to care and maintenance by the end of the year.

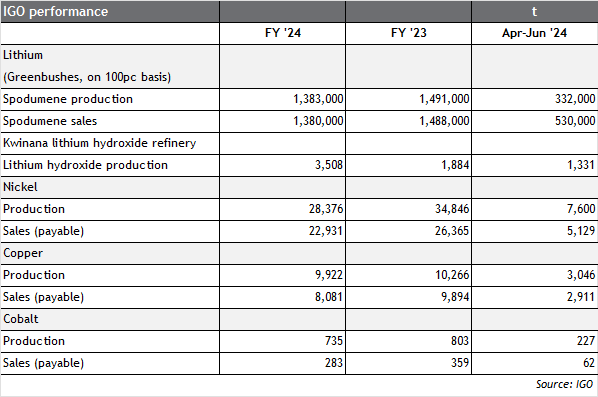

Spodumene production at IGO's Greenbushes site for FY2023-24 reached approximately 1.38 million tons, which is at the higher end of the company's forecasted range of 1.3-1.4 million tons. However, this output is down from the 1.49 million tons produced during the same period last year. Between April and June, spodumene production fell by 16% year-over-year but increased by 19% from the previous quarter to 332,000 tons, thanks to ramped-up processing activities. The production cash cost was A$338 per ton ($222 per ton), and the average realized price was $1,020 per ton FOB Australia.

Lithium hydroxide output for the fiscal year totaled 3,508 tons, up from 1,884 tons the previous year. IGO produced 28,376 tons of nickel and 9,922 tons of copper, with nickel production falling short of its 28,500-31,000 ton guidance, while copper production met the higher end of its 8,500-10,000 ton guidance. The company's Cosmos nickel project in Western Australia remains in care and maintenance, with the Forrestania project set to follow, highlighting difficulties in Australia's nickel sector.

For the upcoming fiscal year, IGO has projected lithium production at Greenbushes to be between 1.35 million and 1.55 million tons. At its Nova site, the company has set production targets for nickel at 16,000-18,000 tons, copper at 6,250-7,250 tons, and cobalt at 550-650 tons.

IGO's Managing Director and CEO, Ivan Vella, noted the ongoing volatility in the lithium market, driven by uncertain demand for electric vehicles (EVs). Despite these challenges, Vella pointed out the strong momentum and uptake in the Chinese EV market. He also warned that medium-term lithium supply might face more significant challenges than anticipated, citing recent project delays by companies such as Galan Lithium and Lake Resources.

We publish to analyze metals and the economy to ensure our progress and success in fierce competition.

We publish to analyze metals and the economy to ensure our progress and success in fierce competition.

No comments

Post a Comment